rhode island tax table 2020

Check the 2021 Rhode Island state tax rate and the rules to calculate state income tax. How to Calculate 2021 Rhode Island State Income Tax by Using State Income Tax Table.

Rhode Island Division Of Taxation 2019

Read the summary of the latest tax changes.

. That sum 122344 multiplied by the marginal rate of 72 is 8809. The Internal Revenue Service IRS is responsible for publishing the latest Tax Tables each year rates are typically published in 4 th quarter of the year proceeding the new tax year. Find your gross income 4.

Find your pretax deductions including 401K flexible account contributions. One Capitol Hill Providence RI 02908. The Rhode Island Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Rhode Island State Income Tax Rates and Thresholds in 2022.

The Rhode Island Department of Revenue is responsible for. We also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. The state sales tax rate in Rhode Island is 7 but.

Of the on amount. Instead if your taxable income is less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7. The table below shows the income tax rates in Rhode Island for all filing statuses.

The Rhode Island tax rate is unchanged from last year however the income tax brackets increased due to the annual. Find your gross income. Vendors reproducing Rhode Island state tax forms must register with the Rhode Island Division of Taxation.

This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in April 2020. Rhode Island Municipality Residential Real Estate Commercial Real Estate Personal Property Motor Vehicles. Latest Tax News.

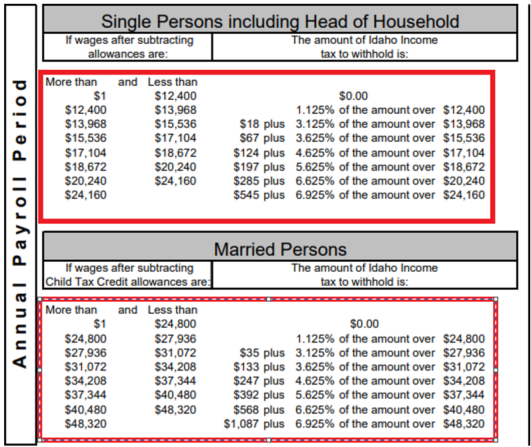

Find your income exemptions 2. Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company. Apply the taxable income computed in step 5 to the following table to determine the annual Rhode Island tax withholding.

Eral the Rhode Island income tax is based on your federal adjusted gross income. 2022 Filing Season FAQs - February 1 2022. Rhode Island Taxable Income Rate.

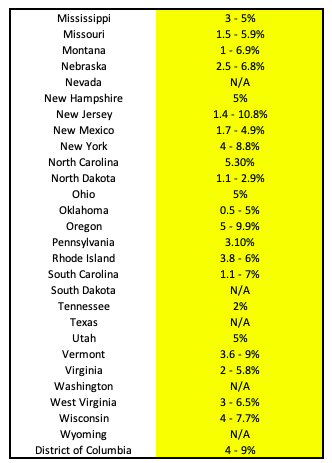

The income tax is progressive tax with rates ranging from 375 up to 599. Printable Rhode Island state tax forms for the 2021 tax year will be based on income earned between January 1 2021 through December 31 2021. Rhode Island state income tax rate table for the 2020 - 2021 filing season has three income tax.

2022 Rhode Island Sales Tax Table. Finally we add 8809 to the base taxes 70800 to get a total Rhode Island estate tax burden of 79609 on a 32 million estate. Check the 2020 Rhode Island state tax rate and the rules to calculate state income tax 5.

How to Calculate 2020 Rhode Island State Income Tax by Using State Income Tax Table 1. Rhode Islands income tax brackets were last changed one year prior to 2020 for tax year 2019 and the tax rates were previously changed in 2009. Income tax tables and other tax information is sourced from the Rhode Island Division of Taxation.

Levels of taxable income. The bottom of the threshold is 154 million so we subtract that from 1662344 million and get 122344. 0 - 66200.

How Income Taxes Are Calculated. This page provides detail of the Federal Tax Tables for 2020 has links to historic Federal Tax Tables which are used within the 2020 Federal Tax Calculator and has supporting links to each set of state. DO NOT use to figure your Rhode Island tax.

Rhode Island state income tax Form RI-1040 must be postmarked by April 18 2022 in order to avoid penalties and late fees. No Tax Knowledge Needed. Rhode Island Division of Taxation.

Detailed Rhode Island state income tax. 2020 Income Tax Withholding Instructions Tables and. The Rhode Island State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 Rhode Island State Tax Calculator.

The Rhode Island income tax rate for tax year 2021 is progressive from a low of 375 to a. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that. Rhode Island state income tax rate table for the 2020 - 2021 filing season has three income tax brackets with RI tax rates of 375 475 and 599 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses.

This page has the latest Rhode Island brackets and tax rates plus a Rhode Island income tax calculator. PPP loan forgiveness - forms FAQs guidance. RHODE ISLAND TAX RATE SCHEDULE 2020 TAX RATES APPLICABLE TO ALL FILING STATUS TYPES Taxable Income line 7 Over 0 65250 148350 But not over Pay--of the amount over 244688 639413 375 475 599 on excess 0 65250 148350.

65250 148350 CAUTION. Revised withholding tables effective 112019. Rhode Island standard deduction amounts by tax year Filing status 2019 2020 Single 8750 8900 Married filing jointly 17500 17800 Head of household 13100 13350 Married filing separately 8750 8900 Or qualifying widow or widower.

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. 2020 Rhode Island State Tax Tables. Rhode Islands 2022 income tax ranges from 375 to 599.

If your taxable income is larger than 100000 use the Rhode Island Tax Computation Worksheet located on page T-1. TurboTax Makes It Easy To Get Your Taxes Done Right. Find your pretax deductions including 401K flexible account contributions.

The Rhode Island State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Rhode Island State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. Divide the annual Rhode Island tax withholding by 26 to obtain the. If you have experienced a hardship in 2021 you may be able to apply for an exemption through HealthSource RI.

Details of the personal income tax rates used in the 2022 Rhode Island State Calculator are published below. The COVID-19 exemption for 2020 allowed through HealthSource RIs regulation has expired. Find your income exemptions.

Some Rhode Island tax-related amounts for 2020 including income tax bracket thresholds and the standard deduction were released Nov. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. However if Annual wages are more than 241850 Exemption is 0.

Masks are required when visiting Divisions office. Multiply the adjusted gross biweekly wages times 26 to obtain the gross annual wages.

Rhode Island Income Tax Brackets 2020

Rhode Island Landlord Tenant Laws Updated 2020 Payrent

Tax Rate Schedules And Important Rules For 1099 Contractors Taxhub

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Rhode Island Income Tax Rate And Ri Tax Brackets 2020 2021

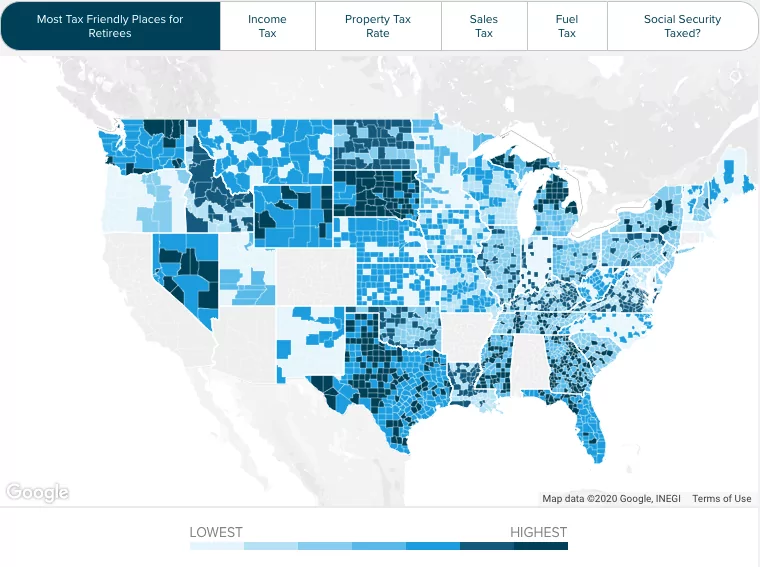

Rhode Island Income Tax Calculator Smartasset

Rhode Island Tax Forms And Instructions For 2021 Form Ri 1040

Historical Rhode Island Tax Policy Information Ballotpedia

Rhode Island Income Tax Calculator Smartasset

State W 4 Form Detailed Withholding Forms By State Chart

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Rhode Island Retirement Tax Friendliness Smartasset